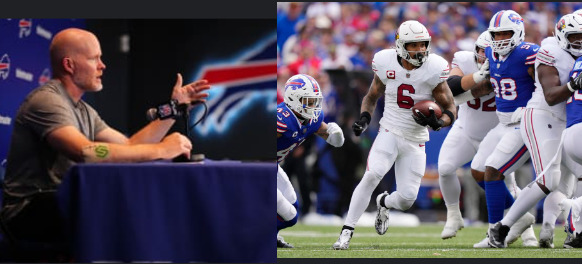

As they start practice week ahead of their game against the Jacksonville Jaguars, the Buffalo Bills are ruling out two players on their starting defense. Due to forearm and pectoral injuries, respectively, coach Sean McDermott has officially ruled out linebacker Terrel Bernard and cornerback Taron Johnson for Week 3. As they continue to assess each player’s recuperation, the team has not yet placed either on injured reserve.

As Bernard was hurt early in Buffalo’s victory over the Miami Dolphins in Week 2, Baylon Spector will start at middle linebacker. Dorian Williams, a second-year linebacker who will play weak-side linebacker, will start beside him. “It’s an opportunity for Baylon and Dorian to work together, like they did in the back half of the game, or really, the majority of the game the other night [against Miami],” said Sean McDermott, the team’s coach.

Against the Dolphins, Spector gave the defense a major lift in Bernard’s absence. He finished the game with ten total tackles, which is already a season high for him.

This will be Johnson’s second consecutive game missed after he was hurt during the first half of the season opener for the Bills. Though he was unable to tell if defensive ends Dawuane Smoot and Javon Solomon would be available to play against Jacksonville, McDermott was able to affirm that they will be returning to practice this week.

Hardwick’s proposal to allow Bills supporters to purchase stadium bonds garners national notice.

To assist in financing the development of the new Bills stadium, Erie County is offering special “Bills bonds” to fans of the team as well as other locals. Comptroller Kevin Hardwick discusses why, in his opinion, typical Bills supporters need to be the first to receive these bonds.

Kevin Hardwick, the comptroller of Erie County, had a busy morning on Tuesday.

He was interviewed in the morning by a CNBC web reporter. He then needed to return a call from a reporter for the trade newspaper Bond Buyer. He mentioned that he had previously communicated with representatives from SI.com, CNBC, and National Public Radio’s “Marketplace” program.

They’re all interested in the same thing: his proposal to sell municipal bonds to Buffalo Bills supporters and neighborhood people who wish to put money into “Bills bonds,” which will be used to pay for the building of the new stadium.

“It’s crucial that people got the chance,” he stated. “I hope everyone is happy in the end.”

To help finance the construction of the new Highmark Stadium, Erie County is allowing Bills supporters to purchase “Bills bonds” for a single day only, in an unprecedented action. Still, it’s not an inexpensive or simple operation.

Harry Scull Jr.

One day alone, on September 23, the day before the sale opens to outside investors, will be dedicated to the retail sale of Bills bonds to individual customers. The county’s $250 million stadium construction obligation will be partially funded by the bonds. Cash payment is made in part. These bonds are used to cover the remaining $125 million in payments.

The Bills bonds will be 25-year bonds that pay investors interest income twice a year in exchange for an initial investment of at least $5,000. However, it looks likely that they could be paid off and refinanced early. A retail investor’s maximum permitted investment is $250,000. Erie County has an investment-grade credit rating of AA, which is regarded solid, and bond rating agencies are anticipated to buy up any remaining county bonds after Monday.

To buy the bonds, a buyer must register and fund a brokerage account with one of the companies taking part in the initial bond offering. That includes J.P. Morgan, TD Securities, Raymond James, Jefferies, and Ramirez & Co. There is a link on Buybillsbonds.com to obtain additional information.

Local investors will be given preference when buying bonds, according to Hardwick. There might be a chance for small retail investors that live outside the area to purchase.

“On our first day, the retail day, we will exert every effort to ensure that smaller investors, especially those in Erie County, have a fair chance,” he declared.